Detection Technology

13,85 EUR −0,36%Detection Technology on on vuonna 1991 perustettu globaali röntgenilmaisimien ratkaisutoimittaja lääketieteen, turvallisuusalan ja teollisuuden sovelluksiin. Yhtiön ratkaisut ulottuvat sensorikomponenteista optimoituihin ilmaisinjärjestelmiin, joissa on mikropiirejä, elektroniikkaa, mekaniikkaa, ohjelmistoja ja algoritmeja.

Kirjaudu sisään nähdäksesi Inderesin suosituksen ja riskitason

Viimeisimmät analyysit

Laaja raportti

Analyst

Viimeisimmät videot

Pörssikalenteri

Suurimmat omistajatLähde: Millistream Market Data AB

| Omistaja | Osuus | Ääniä |

|---|---|---|

| Ahlstrom Capital Bv | 36,0 % | 36,0 % |

| OP-Finland Value Fund | 4,2 % | 4,2 % |

Inderes Premium

Tämä sisältö on vain Inderes Premium -käyttäjille.

Sisäpiirin kaupat

| Ilmoittaja | Päivämäärä | Yhteensä |

|---|---|---|

| Wu Chen | 11.08.2023 | 14 000EUR |

| Wu Chen | 07.08.2023 | 14 000EUR |

Inderes Premium

Tämä sisältö on vain Inderes Premium -käyttäjille.

Foorumin keskustelut

Tuloslaskelma

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Liikevaihto | 81,6 | 89,8 | 98,6 | 103,8 | 111,4 | 124,5 | 138,1 | 152,5 |

| kasvu-% | −20,4 % | 10,1 % | 9,8 % | 5,3 % | 7,4 % | 11,7 % | 11,0 % | 10,4 % |

| Käyttökate | 12,0 | 13,9 | 9,0 | 11,8 | 17,6 | 22,3 | 27,0 | 29,8 |

| EBIT (oik.) | 8,9 | 10,6 | 6,1 | 9,7 | 13,9 | 18,6 | 22,9 | 25,3 |

| EBIT | 8,7 | 10,6 | 5,8 | 8,2 | 12,7 | 17,5 | 21,8 | 24,2 |

| Tulos ennen veroja | 8,1 | 11,4 | 5,6 | 7,3 | 12,9 | 17,5 | 21,8 | 24,3 |

| Nettotulos | 6,7 | 9,3 | 5,1 | 5,5 | 10,6 | 13,9 | 17,3 | 19,2 |

| EPS (oik.) | 0,48 | 0,64 | 0,37 | 0,47 | 0,80 | 1,03 | 1,25 | 1,39 |

| kasvu-% | −47,6 % | 32,4 % | −41,4 % | 27,6 % | 68,6 % | 28,5 % | 22,0 % | 10,6 % |

| Osinko | 0,28 | 0,35 | 0,20 | 0,23 | 0,36 | 0,48 | 0,59 | 0,66 |

| Osingonjakosuhde | 59,8 % | 55,1 % | 57,3 % | 61,1 % | 50,0 % | 50,0 % | 50,0 % | 50,0 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Kannattavuus ja pääoman tuotto

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Käyttökate-% | 14,7 % | 15,4 % | 9,2 % | 11,3 % | 15,8 % | 17,9 % | 19,5 % | 19,5 % |

| EBIT-% (oik.) | 10,9 % | 11,8 % | 6,2 % | 9,3 % | 12,4 % | 15,0 % | 16,6 % | 16,6 % |

| EBIT-% | 10,7 % | 11,8 % | 5,9 % | 7,9 % | 11,4 % | 14,1 % | 15,8 % | 15,9 % |

| Oman pääoman tuotto-% | 11,5 % | 14,1 % | 7,0 % | 7,6 % | 13,9 % | 16,5 % | 18,4 % | 18,4 % |

| Sijoitetun pääoman tuotto-% | 13,8 % | 15,1 % | 7,7 % | 10,7 % | 15,7 % | 20,0 % | 22,7 % | 22,9 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Arvostus

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Osakekurssi (EUR) | 23,90 | 29,30 | 16,90 | 13,70 | 13,85 | 13,85 | 13,85 | 13,85 |

| Osakemäärä | 14,4 | 14,7 | 14,7 | 14,7 | 14,7 | 14,7 | 14,7 | 14,7 |

| Markkina-arvo | 343,6 | 429,4 | 247,7 | 200,8 | 203,0 | 203,0 | 203,0 | 203,0 |

| Yritysarvo | 324,2 | 401,8 | 227,1 | 188,1 | 182,8 | 176,3 | 170,8 | 163,7 |

| EV/S | 4,0 | 4,5 | 2,3 | 1,8 | 1,6 | 1,4 | 1,2 | 1,1 |

| EV/EBITDA | 27,1 | 29,0 | 25,2 | 16,0 | 10,4 | 7,9 | 6,3 | 5,5 |

| EV/EBIT (oik.) | 36,5 | 38,0 | 37,0 | 19,5 | 13,2 | 9,5 | 7,4 | 6,5 |

| EV/EBIT | 37,2 | 38,0 | 39,1 | 22,9 | 14,4 | 10,1 | 7,8 | 6,8 |

| P/E (oik.) | 49,8 | 46,1 | 45,4 | 28,9 | 17,3 | 13,5 | 11,0 | 10,0 |

| P/E | 51,0 | 46,1 | 48,4 | 36,4 | 19,2 | 14,6 | 11,8 | 10,6 |

| P/B | 5,9 | 5,8 | 3,4 | 2,8 | 2,5 | 2,3 | 2,1 | 1,9 |

| P/S | 4,2 | 4,8 | 2,5 | 1,9 | 1,8 | 1,6 | 1,5 | 1,3 |

| Osinkotuotto | 1,2 % | 1,2 % | 1,2 % | 1,7 % | 2,6 % | 3,4 % | 4,3 % | 4,7 % |

| Omavaraisuusaste | 77,3 % | 80,0 % | 79,8 % | 77,4 % | 79,7 % | 79,9 % | 81,6 % | 81,7 % |

| Nettovelkaisuusaste | −33,1 % | −37,6 % | −28,3 % | −17,4 % | −25,3 % | −30,1 % | −32,5 % | −35,9 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

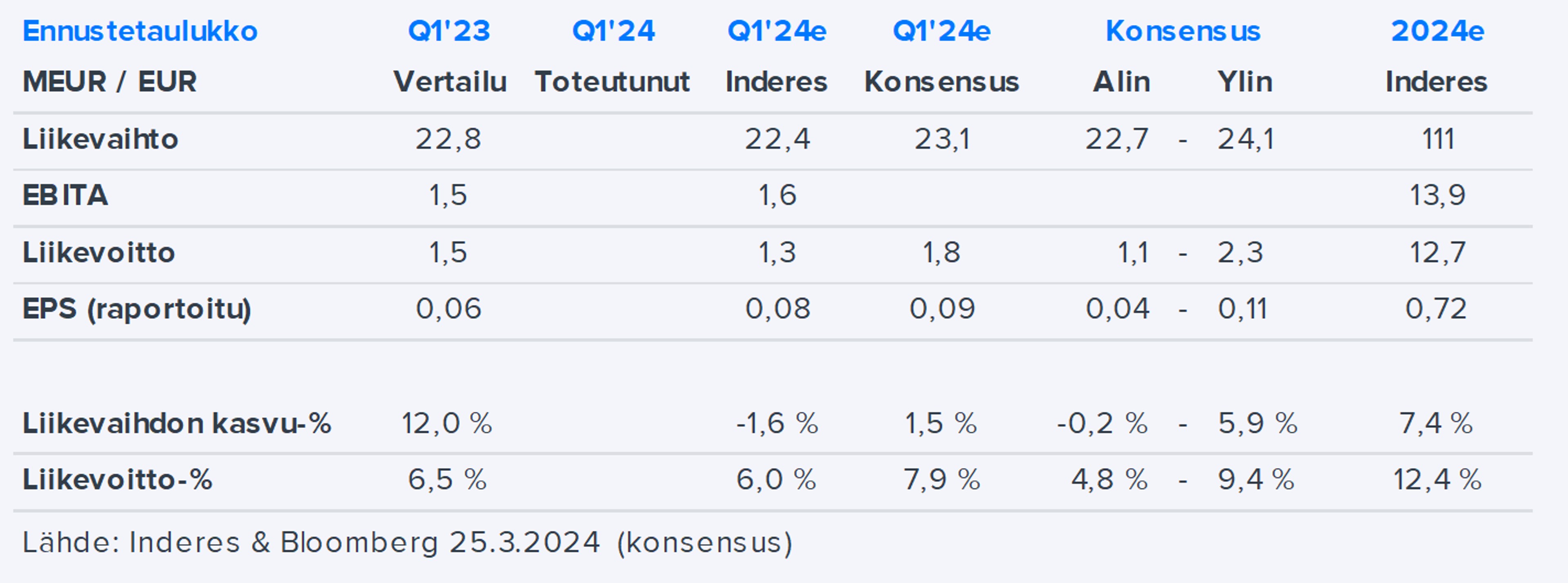

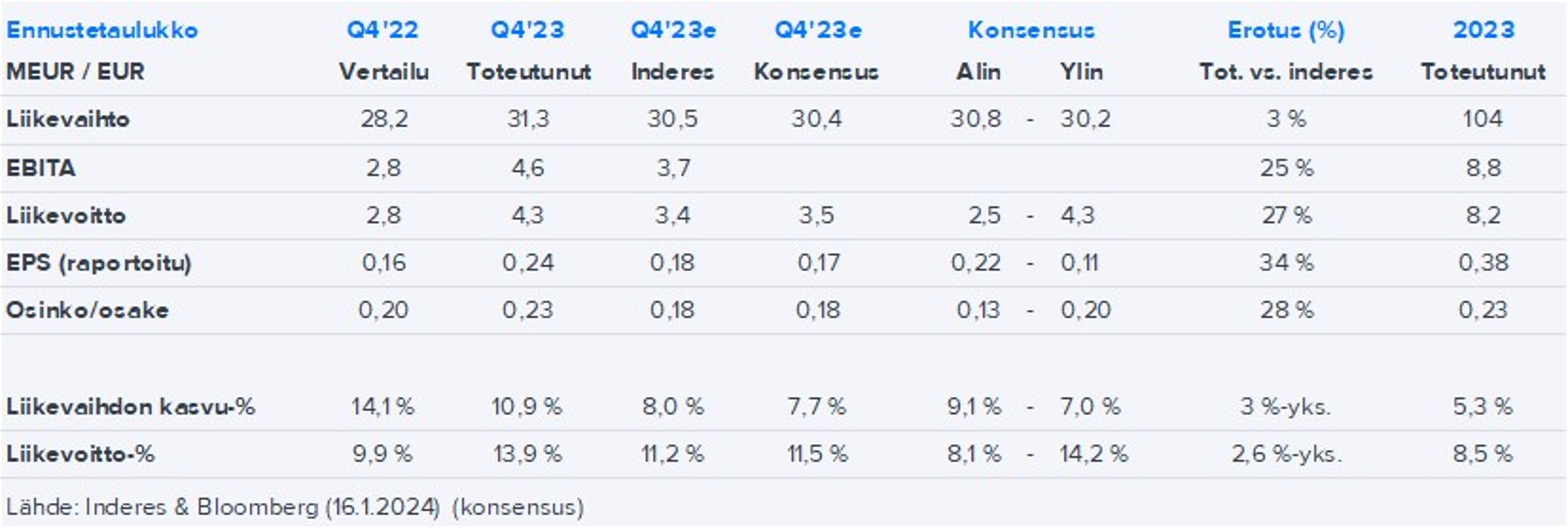

Neljännesluvut

| Q1/23 | Q2/23 | Q3/23 | Q4/23 | 2023 | Q1/24e | Q2/24e | Q3/24e | Q4/24e | |

|---|---|---|---|---|---|---|---|---|---|

| Liikevaihto | 22,8 | 25,2 | 24,5 | 31,3 | 103,8 | 22,4 | 25,7 | 28,4 | 35,0 |

| Käyttökate | 2,2 | 2,1 | 2,2 | 5,2 | 11,8 | 2,5 | 3,3 | 4,6 | 7,2 |

| EBIT | 1,5 | 1,4 | 1,1 | 4,3 | 8,2 | 1,3 | 2,1 | 3,3 | 5,9 |

| Tulos ennen veroja | 1,2 | 0,8 | 1,0 | 4,3 | 7,3 | 1,3 | 2,2 | 3,3 | 6,0 |

| Nettotulos | 0,8 | 0,5 | 0,7 | 3,6 | 5,5 | 1,1 | 1,8 | 2,7 | 5,0 |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Detection Technology Oyj: Detection Technologyn hallituksen järjestäytymiskokous

Detection Technology Oyj: Resolutions of the Annual General Meeting of Detection Technology

Liity Inderesin yhteisöön

Älä jää mistään paitsi – luo käyttäjätunnus ja ota kaikki hyödyt irti Inderesin palvelusta.