Innofactor

1,325 EUR +0,76%Vuonna 2000 perustettu Innofactor on yksi Pohjoismaiden johtavia Microsoft-ratkaisuihin keskittyneitä ohjelmistotoimittajia. Yhtiön liiketoiminta koostuu järjestelmäintegraattorina toimimisesta IT-projekteissa sekä omien ohjelmistotuotteiden ja -palveluiden kehittämisestä ja myynnistä. Innofactorin liiketoiminta keskittyy Pohjoismaihin.

Viimeisimmät analyysit

Laaja raportti

Analyst

Viimeisimmät videot

Pörssikalenteri

Suurimmat omistajatLähde: Millistream Market Data AB

| Omistaja | Osuus | Ääniä |

|---|---|---|

| Ensio Sami | 21,8 % | 21,8 % |

| Ilmarinen Mutual Pension Insurance Company | 5,0 % | 5,0 % |

Inderes Premium

Tämä sisältö on vain Inderes Premium -käyttäjille.

Sisäpiirin kaupat

| Ilmoittaja | Päivämäärä | Yhteensä |

|---|---|---|

| Vesa Syrjäkari | 26.05.2023 | 63 734EUR |

| Vesa Syrjäkari | 25.05.2023 | 8 334EUR |

Inderes Premium

Tämä sisältö on vain Inderes Premium -käyttäjille.

Foorumin keskustelut

Tuloslaskelma

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Liikevaihto | 66,2 | 66,4 | 71,1 | 80,3 | 82,8 | 86,9 | 90,4 | 93,2 |

| kasvu-% | 3,1 % | 0,3 % | 7,2 % | 12,8 % | 3,2 % | 4,9 % | 4,1 % | 3,1 % |

| Käyttökate | 7,2 | 10,1 | 7,8 | 9,1 | 9,7 | 10,5 | 10,9 | 11,3 |

| EBIT (oik.) | 4,5 | 4,4 | 5,0 | 6,0 | 6,7 | 7,7 | 8,0 | 8,2 |

| EBIT | 2,5 | 6,5 | 4,8 | 5,8 | 6,7 | 7,5 | 7,8 | 8,2 |

| Tulos ennen veroja | 2,1 | 5,7 | 4,2 | 5,2 | 6,1 | 7,2 | 7,8 | 8,3 |

| Nettotulos | 1,8 | 4,5 | 3,3 | 3,4 | 4,8 | 5,8 | 6,2 | 6,6 |

| EPS (oik.) | 0,10 | 0,07 | 0,10 | 0,10 | 0,14 | 0,17 | 0,18 | 0,18 |

| kasvu-% | 51,2 % | −35,1 % | 49,8 % | 3,0 % | 34,7 % | 22,1 % | 7,7 % | 3,1 % |

| Osinko | 0,04 | 0,08 | 0,06 | 0,07 | 0,08 | 0,09 | 0,10 | 0,10 |

| Osingonjakosuhde | 84,9 % | 65,1 % | 65,4 % | 72,8 % | 59,0 % | 55,9 % | 57,5 % | 54,4 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Kannattavuus ja pääoman tuotto

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Käyttökate-% | 10,8 % | 15,2 % | 11,0 % | 11,3 % | 11,7 % | 12,0 % | 12,1 % | 12,1 % |

| EBIT-% (oik.) | 6,8 % | 6,6 % | 7,1 % | 7,5 % | 8,0 % | 8,8 % | 8,9 % | 8,8 % |

| EBIT-% | 3,8 % | 9,8 % | 6,7 % | 7,3 % | 8,0 % | 8,6 % | 8,7 % | 8,8 % |

| Oman pääoman tuotto-% | 7,7 % | 18,4 % | 13,2 % | 13,7 % | 18,2 % | 19,7 % | 19,3 % | 18,7 % |

| Sijoitetun pääoman tuotto-% | 6,9 % | 17,7 % | 12,8 % | 15,8 % | 19,0 % | 22,0 % | 23,5 % | 23,5 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Arvostus

| 2020 | 2021 | 2022 | 2023 | 2024e | 2025e | 2026e | 2027e | |

|---|---|---|---|---|---|---|---|---|

| Osakekurssi (EUR) | 1,28 | 1,52 | 1,05 | 1,23 | 1,33 | 1,33 | 1,33 | 1,33 |

| Osakemäärä | 37,4 | 36,6 | 36,2 | 35,7 | 35,7 | 35,7 | 35,7 | 35,7 |

| Markkina-arvo | 47,7 | 55,5 | 38,1 | 43,8 | 47,4 | 47,4 | 47,4 | 47,4 |

| Yritysarvo | 60,0 | 63,3 | 50,5 | 53,0 | 51,2 | 47,7 | 43,1 | 40,2 |

| EV/S | 0,9 | 1,0 | 0,7 | 0,7 | 0,6 | 0,5 | 0,5 | 0,4 |

| EV/EBITDA | 8,4 | 6,3 | 6,5 | 5,8 | 5,3 | 4,6 | 3,9 | 3,6 |

| EV/EBIT (oik.) | 13,3 | 14,4 | 10,0 | 8,8 | 7,7 | 6,2 | 5,4 | 4,9 |

| EV/EBIT | 24,0 | 9,7 | 10,6 | 9,1 | 7,7 | 6,4 | 5,5 | 4,9 |

| P/E (oik.) | 12,7 | 23,2 | 10,8 | 12,2 | 9,8 | 8,0 | 7,4 | 7,2 |

| P/E | 27,1 | 12,3 | 11,5 | 12,7 | 9,8 | 8,2 | 7,6 | 7,2 |

| P/B | 2,0 | 2,2 | 1,5 | 1,7 | 1,7 | 1,5 | 1,4 | 1,3 |

| P/S | 0,7 | 0,8 | 0,5 | 0,5 | 0,6 | 0,5 | 0,5 | 0,5 |

| Osinkotuotto | 3,1 % | 5,3 % | 5,7 % | 5,7 % | 6,0 % | 6,8 % | 7,6 % | 7,6 % |

| Omavaraisuusaste | 41,4 % | 49,9 % | 44,4 % | 46,8 % | 50,6 % | 57,6 % | 61,8 % | 63,1 % |

| Nettovelkaisuusaste | 52,6 % | 30,8 % | 50,0 % | 36,1 % | 13,7 % | 1,0 % | −12,7 % | −19,6 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Neljännesluvut

| Q2/23 | Q3/23 | Q4/23 | 2023 | Q1/24 | Q2/24e | Q3/24e | Q4/24e | 2024e | |

|---|---|---|---|---|---|---|---|---|---|

| Liikevaihto | 20,1 | 18,0 | 21,9 | 80,3 | 21,2 | 20,4 | 18,6 | 22,6 | 82,8 |

| Käyttökate | 1,8 | 2,0 | 2,9 | 9,1 | 2,6 | 1,8 | 2,2 | 3,1 | 9,7 |

| EBIT | 1,0 | 1,2 | 1,9 | 5,8 | 1,8 | 1,1 | 1,4 | 2,3 | 6,7 |

| Tulos ennen veroja | 0,8 | 1,4 | 1,6 | 5,2 | 1,7 | 0,9 | 1,3 | 2,1 | 6,1 |

| Nettotulos | 0,5 | 1,1 | 0,9 | 3,4 | 1,3 | 0,7 | 1,0 | 1,7 | 4,8 |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Innofactor: Tasaisen hyvää tekemistä haastavassa markkinassa

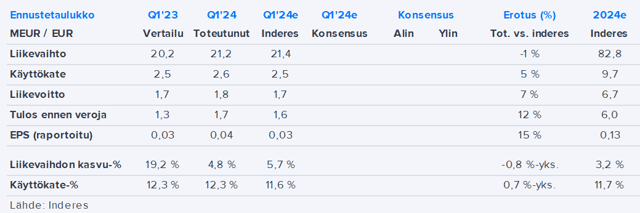

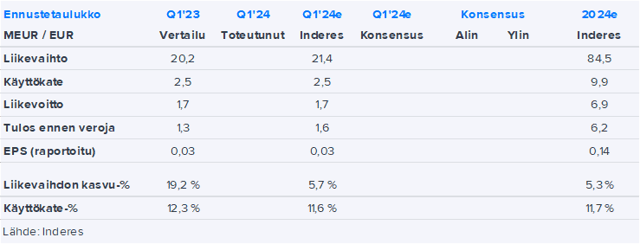

Innofactor Q1’24: Hintakilpailu käy kireänä

Liity Inderesin yhteisöön

Älä jää mistään paitsi – luo käyttäjätunnus ja ota kaikki hyödyt irti Inderesin palvelusta.

FREE-tili

PREMIUM-tili

Innofactor Plc’s Interim Report for January 1–March 31, 2024 (IFRS)

Innofactor Oyj:n osavuosikatsaus 1.1.–31.3.2024 (IFRS)

Innofactor Q1 tiistaina: Yhtiölle tyydyttävä neljännes odotuksissa, mikä on kuitenkin sektoria parempi

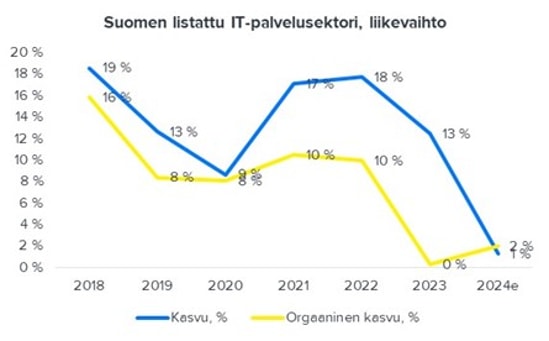

IT-palvelusektori: Odotuksemme vuodelle 2024 pääsääntöisesti yhtiöiden ohjeistuksien alalaidalla

Decisions of Innofactor Plc’s Annual General Meeting and the organizing meeting of the Board of Directors

Innofactor Oyj:n varsinaisen yhtiökokouksen ja hallituksen järjestäytymiskokouksen päätökset

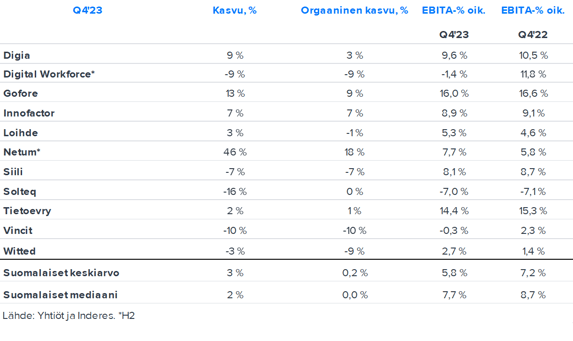

IT-palvelusektori: Yhtiökohtaiset erot korostuvat

IT-palvelusektori Q4-yhteenveto: Kasvu ja kannattavuus linjassa odotuksiimme, vuotta 2023 voidaan pitää torjuntavoittona

Innofactorin vuoden 2023 vuosikertomus on julkaistu

Innofactor Plc Annual Report for 2023 has been published

Jatkuva hyvä tekeminen lisää luottamusta

Innofactor Q4: Jatkuva hyvä tekeminen lisää luottamusta