Nexstim

2,3 EUR −1,29%Nexstim on vuonna 2000 perustettu suomalainen kansainvälisillä markkinoilla toimiva terveysteknologiayhtiö, jonka tuotteet mahdollistavat aivokuoren toiminnallisten alueiden kartoituksen ja halutun aivoalueen tarkan stimuloinnin sähkökentän avulla. Nexstimin liiketoiminta jakaantuu diagnostiikka- (Navigated Brain Stimulation NBS) ja terapia (Navigated Brain Therapy NBT) -liiketoimintoihin. Yhtiö on hiljattain alkanut tarjota asiakkailleen myös yhdistelmälaitteistoja, jotka sisältävät sekä NBS- että NBT-toiminnallisuudet. Nexstimillä on asiakkaita useassa kymmenessä maassa.

Lue lisääKirjaudu sisään nähdäksesi Inderesin suosituksen ja riskitason

Viimeisimmät analyysit

Laaja raportti

Analyst

Viimeisimmät videot

Pörssikalenteri

Suurimmat omistajatLähde: Millistream Market Data AB

| Omistaja | Osuus | Ääniä |

|---|---|---|

| Kaikarhenni | 15,1 % | 15,1 % |

| Haapaniemi Ossi | 7,4 % | 7,4 % |

Inderes Premium

Tämä sisältö on vain Inderes Premium -käyttäjille.

Sisäpiirin kaupat

| Ilmoittaja | Päivämäärä | Yhteensä |

|---|---|---|

| Mikko Karvinen | 17.04.2023 | 35 000EUR |

| Mikko Karvinen | 10.10.2022 | 17 700EUR |

Inderes Premium

Tämä sisältö on vain Inderes Premium -käyttäjille.

Foorumin keskustelut

Tuloslaskelma

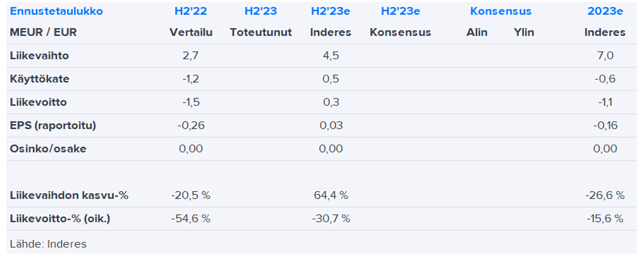

| 2019 | 2020 | 2021 | 2022 | 2023e | 2024e | 2025e | 2026e | |

|---|---|---|---|---|---|---|---|---|

| Liikevaihto | 3,3 | 4,1 | 6,4 | 9,5 | 7,0 | 8,8 | 11,4 | 14,2 |

| kasvu-% | 25,3 % | 22,9 % | 55,5 % | 48,9 % | −26,6 % | 25,7 % | 29,6 % | 24,9 % |

| Käyttökate | −6,2 | −3,0 | −1,0 | 1,3 | −0,6 | 0,2 | 1,3 | 1,9 |

| EBIT (oik.) | −6,5 | −3,3 | −1,5 | 0,8 | −1,1 | −0,4 | 0,7 | 1,4 |

| EBIT | −6,5 | −3,3 | −1,5 | 0,8 | −1,1 | −0,4 | 0,7 | 1,4 |

| Tulos ennen veroja | −6,8 | −4,1 | −0,7 | 1,3 | −1,2 | −0,5 | 0,6 | 1,2 |

| Nettotulos | −6,8 | −4,1 | −0,8 | 1,3 | −1,2 | −0,5 | 0,6 | 1,2 |

| EPS (oik.) | −0,11 | −0,01 | −0,11 | 0,18 | −0,17 | −0,07 | 0,08 | 0,16 |

| kasvu-% | −191,7 % | 93,3 % | ||||||

| Osinko | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,04 |

| Osingonjakosuhde | 25,0 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Kannattavuus ja pääoman tuotto

| 2019 | 2020 | 2021 | 2022 | 2023e | 2024e | 2025e | 2026e | |

|---|---|---|---|---|---|---|---|---|

| Käyttökate-% | −185,7 % | −72,1 % | −15,8 % | 13,8 % | −8,0 % | 2,2 % | 11,0 % | 13,4 % |

| EBIT-% (oik.) | −194,7 % | −81,0 % | −22,7 % | 8,8 % | −15,6 % | −4,8 % | 6,2 % | 10,0 % |

| EBIT-% | −194,7 % | −81,0 % | −22,7 % | 8,8 % | −15,6 % | −4,8 % | 6,2 % | 10,0 % |

| Oman pääoman tuotto-% | 1 312,0 % | 373,1 % | −96,0 % | 36,0 % | −34,6 % | −20,0 % | 22,9 % | 33,1 % |

| Sijoitetun pääoman tuotto-% | −96,5 % | −73,1 % | −27,2 % | 11,4 % | −15,2 % | −5,9 % | 8,8 % | 16,6 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Arvostus

| 2019 | 2020 | 2021 | 2022 | 2023e | 2024e | 2025e | 2026e | |

|---|---|---|---|---|---|---|---|---|

| Osakekurssi (EUR) | 2,27 | 7,66 | 4,78 | 4,11 | 2,30 | 2,30 | 2,30 | 2,30 |

| Osakemäärä | 62,8 | 439,6 | 7,3 | 7,3 | 7,3 | 7,3 | 7,3 | 7,3 |

| Markkina-arvo | 142,3 | 3 366,2 | 34,8 | 29,9 | 16,7 | 16,7 | 16,7 | 16,7 |

| Yritysarvo | 144,3 | 3 367,8 | 33,5 | 28,9 | 17,0 | 17,5 | 17,1 | 16,0 |

| EV/S | 43,1 | 818,6 | 5,2 | 3,0 | 2,4 | 2,0 | 1,5 | 1,1 |

| EV/EBITDA | - | - | - | 22,0 | - | 88,9 | 13,6 | 8,4 |

| EV/EBIT (oik.) | - | - | - | 34,6 | - | - | 24,2 | 11,2 |

| EV/EBIT | - | - | - | 34,6 | - | - | 24,2 | 11,2 |

| P/E (oik.) | - | - | - | 22,8 | - | - | 27,5 | 14,3 |

| P/E | - | - | - | 22,8 | - | - | 27,5 | 14,3 |

| P/B | - | - | 10,9 | 7,3 | 5,8 | 7,1 | 5,7 | 4,1 |

| P/S | 42,5 | 818,2 | 5,4 | 3,1 | 2,4 | 1,9 | 1,5 | 1,2 |

| Osinkotuotto | 1,8 % | |||||||

| Omavaraisuusaste | −9,7 % | −23,5 % | 31,9 % | 39,8 % | 29,2 % | 20,8 % | 22,0 % | 28,0 % |

| Nettovelkaisuusaste | −271,7 % | −108,1 % | −40,6 % | −23,4 % | 9,2 % | 33,5 % | 12,3 % | −17,1 % |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Neljännesluvut

| Q3/22 | Q4/22 | 2022 | Q1/23 | Q2/23 | Q3/23e | Q4/23e | 2023e | Q1/24e | |

|---|---|---|---|---|---|---|---|---|---|

| Liikevaihto | 2,7 | 9,5 | 2,5 | 4,5 | 7,0 | ||||

| Käyttökate | −1,2 | 1,3 | −1,2 | 0,5 | −0,6 | ||||

| EBIT | −1,5 | 0,8 | −1,4 | 0,3 | −1,1 | ||||

| Tulos ennen veroja | −1,9 | 1,3 | −1,4 | 0,2 | −1,2 | ||||

| Nettotulos | −1,9 | 1,3 | −1,4 | 0,2 | −1,2 |

Sisäänkirjautuminen vaadittu

Tämä sisältö on näkyvissä vain sisäänkirjautuneille käyttäjille

Nexstim Oyj on päättänyt uudesta optio-ohjelmasta 2024H

Nexstim Plc Resolved on a New Stock Option Plan 2024H

Liity Inderesin yhteisöön

Älä jää mistään paitsi – luo käyttäjätunnus ja ota kaikki hyödyt irti Inderesin palvelusta.

FREE-tili

PREMIUM-tili

Nexstim Plc: Resolutions of the Annual General Meeting of Shareholders

Nexstim Oyj: varsinaisen yhtiökokouksen päätökset

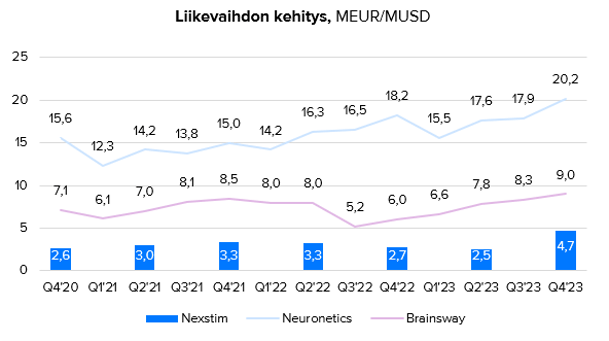

Listatut TMS-yhtiöt ovat päässeet kasvumoodiin

Nexstim Oyj: Kutsu varsinaiseen yhtiökokoukseen

Nexstim Plc: Invitation to the Annual General Meeting

Nexstim Oyj:n vuosikertomus vuodelta 2023 on julkaistu

Nexstim Plc Publishes 2023 Annual Report

Nexstim Receives NBS System 5 Order from Neurosurgery Customer in Germany

Loppuvuosi loi tukevampaa pohjaa tulevalle

Nexstim H2: Loppuvuosi loi tukevampaa pohjaa tulevalle

Nexstim H2’23: Vahva loppuvuosi

NEXSTIM PLC’S FINANCIAL STATEMENTS BULLETIN 2023

NEXSTIM OYJ:N TILINPÄÄTÖSTIEDOTE 2023

Notice of Nexstim Plc’s 2023 Full Year Results