Log in to your Inderes Free account to see all free content on this page.

Ilkka

4.02 EUR

+0.25 %

3,677 following

Corporate customer

ILKKA2

NASDAQ Helsinki

Media & Entertainment

Consumer Goods & Services

Overview

Financials & Estimates

Ownership

Investor consensus

+0.25 %

+3.61 %

+4.69 %

+0.25 %

+9.54 %

+24.84 %

+3.34 %

-18.62 %

+98.79 %

Ilkka is a group providing marketing, technology, and data services that serves corporate customers both in Finland and internationally. The core of Ilkka's business in Finland is Summa Collective, which includes Liana, Evermade, Profinder, MySome and Myyntinmaailma. Internationally, the company focuses especially on Sweden and the Middle East, where they operate through Liana and Profinder. The Group employs a large number of marketing and technology experts, and the head office is in Seinäjoki.

Read moreMarket cap

103.17M EUR

Turnover

86.86K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

P/B (25e)

EV/S (25e)

Dividend yield-% (25e)

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

23.4.

2026

General meeting '26

4.5.

2026

Interim report Q1'26

10.8.

2026

Interim report Q2'26

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

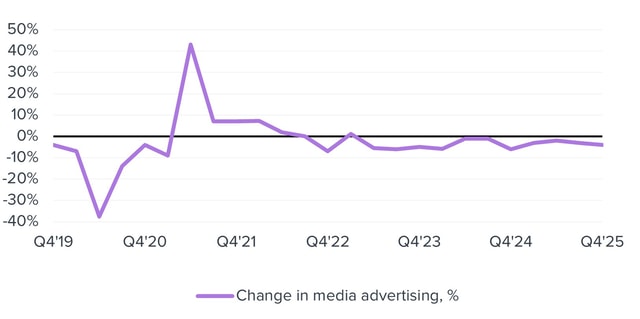

Ad investments continued their downward trend in November

The decline in advertising investments softened in October

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio