Log in to your Inderes Free account to see all free content on this page.

Titanium

7.48 EUR

+0.27 %

6,559 following

Corporate customer

TITAN

First North Finland

Financial Services

Financials

Overview

Financials & Estimates

Ownership

+0.27 %

+18.73 %

+5.35 %

+19.87 %

+22.62 %

-6.73 %

-59.46 %

-52.66 %

+7.32 %

Titanium operates in the financial services industry. The group offers a wide range of financial services, mainly in asset management, loan financing and pensions. The group also manages a number of investment funds and structured financial products. Titanium was originally founded in 2009 and is headquartered in Helsinki.

Read moreMarket cap

77.58M EUR

Turnover

15.32K EUR

P/E (adj.) (26e)

EV/EBIT (adj.) (26e)

P/B (26e)

EV/S (26e)

Dividend yield-% (26e)

Latest research

Latest analysis report

Released: 03.10.2023

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

25.3.

2026

General meeting '26

26.3.

2026

Annual dividend

26.8.

2026

Interim report Q2'26

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

ShowingAll content types

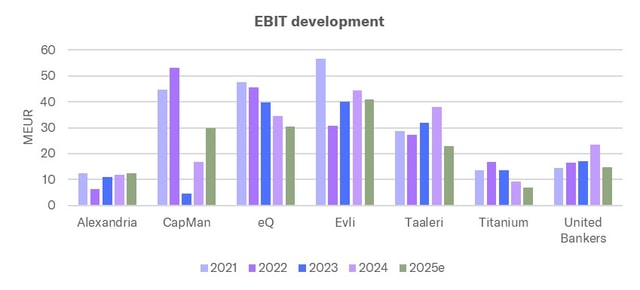

2025 has been a year of ups and downs for asset managers

The financial sector will rank top positions on dividend lists also next spring

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio