The new import duties announced by the United States are causing headaches for several companies on the Helsinki Stock Exchange, in addition to generally weakening the global economic outlook and increasing uncertainty. Under the current US administration, situations can change rapidly, but according to the current plan, the tariffs should come into effect next Wednesday. The indirect effects of the current trade policy, and especially a potentially looming full-blown trade war, are likely to be greater for most companies than the direct effects, but in this compilation, we outline the potential effects of US import duties on various companies and sectors. This is our best estimate of the current impact, but the situation is evolving and uncertainty is now very high.

Overall, the company's Q2 report was fairly neutral compared to our expectations, although we have made moderate negative changes to our near-term forecasts.

In our view, the Q1 report landed on the positive side thanks to the earnings beat and cautiously positive market commentary. We revised our forecasts slightly upwards after the report, although some of the changes were technical.

The Q4 report offered no major negative surprises and no clear prospect of a recovery in the market situation. We made negative revisions to our forecasts for the current year, but in the longer term the changes were small.

Overall, we think that Billerud's Q4 report was bearable given the difficult market conditions, and the report indicates that the bottom of the earnings cycle seems to be behind us, as expected. However, market conditions in the forest sector are not showing any rapid and drastic signs of normalization, which keeps uncertainty high about the major earnings improvement expectations that we believe are loaded into forest stocks in the Nordic packaging sector.

Following the company's weak Q3 report, our near-term estimate revisions for Stora Enso were small but negative.

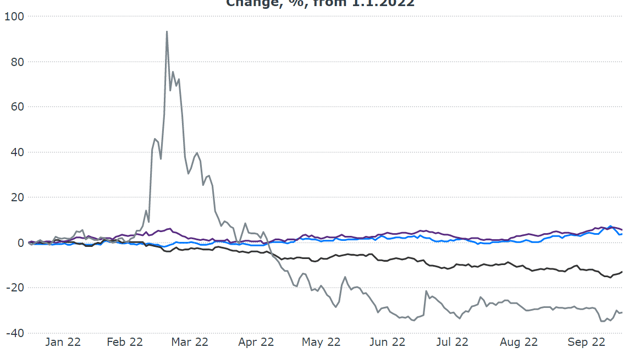

We have reviewed UPM’s, Stora Enso’s and Metsä Board’s post-Q2 consensus forecasts and their changes. Forest companies’ consensus forecasts for 2023 started to decline last fall, when the slowdown in economic growth began to affect the demand outlook (incl. a drop in inventories), global supply improved as COVID bottlenecks eased, and inflation continued.

We reiterate our Reduce recommendation for Stora Enso and cut our target price to EUR 10.50 (was EUR 11.50). We continued to lower our near-term estimates for Stora Enso, as the company's Q2 report was gloomy even compared to the estimates we lowered before the report. From the perspective of long-term investors, misery has already been priced in Stora Enso’s share, but the company is now treading the path of suffering and there are no concrete signs of how far it still has to go. Therefore, we will wait for the news flow to pick up before we are prepared to move our sights further away for Stora Enso.

We reiterate our Reduce recommendation and target price of EUR 11.50 for Stora Enso. The company reports its Q2 results on Friday. We have significantly cut our estimates for Stora Enso, especially for the current year, due to the gloomy market situation in the forest sector that has further deteriorated over the spring. In the long term, the stock is still not expensive, but the short-term valuation is high (2023e-2024e: P/E 27x and 13x) and rapid upward drivers are conspicuous by their absence. We still prefer UPM and Metsä Board, which we believe offer slightly better risk/return ratios in the forest sector, which is favorably valued for long-term investors.

Stora Enso's short-term market situation is strong and robust earnings growth seems to continue this year. However, the risk of approaching a cyclical earnings peak is still too great in our view, and we also estimate that the market is also becoming increasingly nervous about that.